Case Synopsis

A 38-year-old, 100% service-disabled African American veteran relocates to Central Florida after retiring from the U.S. Army. When Hurricane Milton devastates the region, leaving millions of cubic yards of debris, FEMA authorizes 100% reimbursement for debris removal contracts completed within 90 days of the disaster declaration (FEMA, 2023b). On paper, the market is wide open. In reality, pre-existing insurance, auditable accounting systems, and capital-backed compliance requirements create structural gates that shut out undercapitalized entrepreneurs (GAO, 2007).

The veteran sees both civic duty and economic opportunity in launching a veteran-led roll-off dumpster company to serve underserved neighborhoods. However, with no startup capital, no insurance, and no formal accounting infrastructure, he fails FEMA’s threshold criteria. Prior consultations with SBA’s veteran small business certification (VetCert) program and the local small business development center reveal a paradox: the very systems intended to empower veterans are inaccessible without the resources they are designed to unlock (SBA, 2025a).

Students are presented with three urgent options:

-

Launch Informally: Serve the community immediately with bootstrapped resources, risking noncompliance, fraud allegations, and the potential loss of VA benefits.

-

Delay and Formalize: Build compliance systems and pursue SDVOSB certification, sacrificing a perishable market window estimated at $25,000-$33,000 in potential revenue (GAO, 2007).

-

Partner with an Established Firm: Gain immediate infrastructure and eligibility but relinquish control, mission identity, and autonomy.

The case asks students to analyze FEMA’s Public Assistance reimbursement framework, the accounting and tax structures that define eligibility, and the ethical question beneath the spreadsheets: when financial systems reward only those who already have, who gets to participate in economic recovery, and at what cost to dignity, agency, and survival?

Universal vs. Veteran-Distinct

veteran-specific barriers arise, including (a) uncertainty over how VA disability compensation interacts with Schedule SE self-employment income, (b) service-connected health limitations affecting operational readiness and creditworthiness, and (c) the timing and documentation demands of certification under 13 CFR Part 128.

By explicitly distinguishing universal from veteran-distinct barriers, the case prevents overgeneralization and equips students to analyze where systemic exclusion is broadly entrepreneurial versus uniquely tied to military service.

Keywords

post-disaster entrepreneurship, disabled veteran small business, FEMA reimbursement, accounting compliance systems, tax and benefit policy, small business capital access, navigating working capital, audit and internal controls, systemic exclusion, stakeholder theory, business ethics and dignity, teaching case.

Background: A Veteran at the Threshold

In the aftermath of Hurricane Milton, demand for waste removal services surged across Central Florida. Amid this environment, a 38-year-old, 100% service-disabled African American veteran attempts to launch a roll-off dumpster business. The case presents students with the operational, financial, regulatory, and ethical challenges of entering a post-disaster market under tight constraints.

When Hurricane Milton left millions of cubic yards of debris scattered across the region, FEMA activated its Public Assistance (PA) program, authorizing 100% reimbursement for eligible debris removal costs incurred during the first 90 days after the disaster declaration (FEMA, 2023b). Designed to accelerate recovery capital, the program requires strict compliance:

-

Request for Public Assistance (RPA) within 30 days of the declaration.

-

Proof of commercial liability insurance prior to contract award.

-

Auditable accounting systems with five-year record retention for federal review.

-

Demonstrated fleet ownership and valid licensing linked to an Employer Identification Number (EIN).

For established firms, these requirements ensure accountability and cost control. For undercapitalized entrepreneurs, they function as high barriers to entry. In Florida, FEMA-compliant commercial liability insurance averages $6,000-$8,000 annually, and basic accounting infrastructure capable of meeting audit standards costs $2,000-$5,000 in initial setup and training (National Taxpayer Advocate, 2023). For a start-up without seed capital, the compliance package becomes financially prohibitive before the first contract is signed.

The 90-day reimbursement policy also creates a cash flow paradox: contractors must front-load labor, equipment, and disposal costs while waiting for federal reimbursement, effectively placing them in a negative working capital position. For undercapitalized veterans, this cash conversion cycle gap is often impossible to bridge without external financing (Berger & Udell, 1998).

Prior to the storm, the veteran had explored SBA’s veteran small business certification (VetCert) and consulted the local small business development center (SBDC). Both avenues required formal business plans, insurance documentation, and accounting records to qualify for contracts or microloans (SBA, 2025a). Lacking startup capital, he was unable to assemble the compliance package, revealing a systemic paradox: programs designed to empower veterans are often inaccessible without the very resources they are intended to unlock (Collis & Jarvis, 2002).

Layered over these financial and accounting barriers is taxation ambiguity. Self-employment income must be reported under IRS Schedule SE, but the interaction between earned income and VA disability compensation remains unclear. Nationally, 41% of disabled veterans cite fear of triggering a benefits review as a reason for avoiding entrepreneurship, highlighting how taxation and benefits policy can unintentionally suppress small business entry (Jan Dils Attorney at Law, 2024; National Taxpayer Advocate, 2023).

For the veteran, the challenge is not simply entrepreneurial readiness; it is navigating a policy landscape where accounting, taxation, and financing structures double as gatekeepers. His decision is both a business choice and a moral one: whether to risk action in a system not built for inclusion or wait until compliance catches up, knowing the market window may already have closed.

Regulation as Safeguard

While regulatory compliance, permits, insurance, and audit-ready systems can feel burdensome, these safeguards exist to protect workers, consumers, communities, and taxpayer funds. They ensure safety standards, prevent fraud, uphold environmental stewardship, and preserve accountability in disaster recovery contracting. The issue for emergent entrepreneurs is not whether such safeguards should exist, but how compliance sequencing and financing can be structured to meet them under severe time and cash constraints. This balance frames the protagonist’s dilemma: inclusion in urgent recovery efforts while still meeting the regulatory responsibilities that safeguard public trust.

Economic Ground Zero: The 90-Day Window

Hurricane Milton left Central Florida blanketed with millions of cubic yards of debris and an overburdened waste infrastructure. In response, FEMA activated its PA program, authorizing 100% reimbursement for eligible debris removal completed within the first 90 days (FEMA, 2017). The intent was clear: inject immediate capital to accelerate cleanup and economic stabilization.

For firms with pre-existing compliance systems, the opportunity was significant. FEMA reimburses debris removal at $18-$22 per cubic yard, meaning a single 30-yard dumpster load generates $540-$660 in billable revenue (FEMA, 2023a). With approximately 5,000 eligible loads countywide, even a conservative 1% market share represented $25,000-$33,000 in gross revenue for a new entrant.

Yet the same 90-day window came with structural barriers that turned policy intent into exclusion for undercapitalized entrepreneurs:

-

Commercial liability insurance, averaging $6,000-$8,000 annually in Florida, was required prior to any contract award.

-

FEMA mandated auditable accounting systems capable of producing five-year records, applying federal standards for internal controls and cost allocation to track labor, equipment hours, and disposal fees (Collis & Jarvis, 2002).

-

A compliant chart of accounts and documented procurement procedures were needed to withstand federal audit.

-

Contracts were cost-reimbursable, forcing contractors to advance labor, fuel, and disposal costs and operate in a negative working capital position until reimbursement cleared.

For the veteran, these requirements created a precise financial equation. The combined cost of minimal compliance, insurance ($6K-$8K), basic accounting software setup and training ($2K-$5K), and a down payment or lease for a single dumpster truck ($15K+), exceeded the lower-bound revenue potential of the first 1% of the market. Without seed capital, the cash conversion cycle (CCC) inherent in FEMA contracts created a liquidity trap: the business would have to operate at a loss upfront to access any reimbursement revenue (Berger & Udell, 1998).

Taxation further complicated the picture. FEMA reimbursements are treated as taxable income for sole proprietors and LLCs, triggering self-employment tax under IRS Schedule SE. Without proactive tax planning and estimated quarterly payments, contractors risk underpayment penalties and cash flow erosion. For disabled veterans, the intersection between self-employment earnings and VA disability compensation creates a policy gray zone that 41% of veteran entrepreneurs cite as a deterrent to business entry (Jan Dils Attorney at Law, 2024; National Taxpayer Advocate, 2023).

GAO data heightens the systemic nature of the barrier. Following Hurricane Katrina, small businesses received 28% of direct federal debris contracts, but less than 5% were awarded to firms with no prior FEMA contract history (GAO, 2007). Post-Hurricane Ian, less than 3% of debris removal awards went to new entrants, while reliance on large external contractors increased municipal cleanup costs by 17% compared to leveraging local providers.

For students, this section frames the dilemma as more than opportunity cost. It asks:

-

Accounting: How do internal controls, cost allocation, and audit-ready systems determine who can access disaster-recovery capital?

-

Taxation: What risks arise when self-employment income intersects with federal benefits and post-disaster cash flows?

-

Financing: How can entrepreneurs bridge a negative working capital position without external equity or debt?

For the veteran, these are not abstract policy questions; they are the calculus of survival. As Kantian ethics warns, when systems define worthiness by pre-existing compliance, they risk reducing human dignity to a ledger line (Furner, 2017). The 90-day window is not just a financial clock, it is a test of agency, identity, and whether economic recovery includes those who were never meant to have a head start.

Source Attrition Note

References to agencies (GAO, SBA, FEMA) are used descriptively to report publicly available data and program requirements; the case does not ascribe motives or advocacy positions to these entities.

Ethical and Existential Dilemma: What Does He Risk Losing?

For the veteran, the decision to act is more than a business calculation, it is a negotiation with identity, survival, and dignity inside systems where accounting ledgers and compliance protocols define who gets permission to participate in recovery.

-

Disability Benefits:

Self-employment income must be reported under IRS Schedule SE and can trigger a VA compensation review. On $25,000 in gross revenue, self-employment tax obligations at 15.3% would consume nearly $3,825 before accounting for operational costs or capital reinvestment. Nationally, 41% of disabled veterans cite income uncertainty as their primary barrier to entrepreneurship, reinforcing how taxation and benefit ambiguity suppress small business entry (Jan Dils Attorney at Law, 2024; National Taxpayer Advocate, 2023). The question becomes not just financial but ethical: does pursuing independence risk erasing the safety net earned through service? -

Autonomy vs. Access:

Partnering with an established contractor grants immediate compliance infrastructure but surrenders mission control. For a veteran seeking to create a distinctly veteran-led enterprise, this trade-off raises a Kantian question: does surrendering autonomy compromise the duty to act as a free moral agent, or is accepting constraint itself an exercise of rational will (Furner, 2017)? In accounting terms, equity and control are not just ownership stakes, they are moral stakes. -

Opportunity Cost:

FEMA’s $18-$22 per cubic yard reimbursement equates to $540-$660 per 30-yard load. A conservative 1% market share equals $25,000-$33,000 in potential gross revenue during the 90-day window (FEMA, 2023). Against compliance costs of $25,000 + (insurance, accounting systems, equipment), the veteran faces a breakeven point that may not be realized before the reimbursement cycle closes. Students can model this using net present value (NPV) or discounted cash flow (DCF) to assess whether immediate informal action offsets compliance investment costs. -

Human Dignity and Existential Agency:

Freedom is claimed in action, not in ideal conditions. In this context, the chart of accounts and internal control systems become more than technical tools, they are the gatekeepers of agency (Sartre, 1946/2007). The decision is not merely whether to launch a business; it is whether to assert identity in a structure that withholds permission. Kant’s principle of treating individuals as ends, not means, is tested when access to economic recovery is determined not by service or need but by pre-existing compliance (Furner, 2017). -

Stakeholders and Harm Allocation:

Applying Freeman’s stakeholder theory reframes the dilemma: who are the legitimate stakeholders, the veteran, the community needing cleanup, FEMA’s audit apparatus, or the lenders protecting capital? Each decision path reallocates harm and benefit among these actors. The question becomes: whose interests are served when accounting and financing structures exclude emergent players from the recovery economy (Freeman, 1984)?

The ethical tension is sharpened by competing harms. Launching informally risks legal exposure, accusations of fraud, and benefit loss. Delaying risks forfeiting a perishable market and the opportunity to serve his community. Partnering risks being tokenized in another’s enterprise. The dilemma is both technical and existential: when internal controls, tax codes, and cash flow models decide access, they do more than track transactions, they draw the boundary of who is allowed to build amidst catastrophe.

Ethical Lenses

Students are challenged to interpret the entrepreneurial dilemma through multiple ethical frameworks:

-

Kantian duty: Compliance and respect for institutions as moral obligations.

-

Utilitarian outcomes: Maximizing net welfare for veterans, communities, workers, and taxpayers.

-

Existential agency (Sartre): Freedom and responsibility to act meaningfully under constraint.

Through applying and comparing these frameworks, students can identify where ethical theories converge and where they diverge. This multi-lens approach encourages deeper reflection and prevents oversimplified judgements.

Decision Points: Design Your Path

Having examined the FEMA reimbursement cycle and the ethical tensions surrounding compliance, the case culminates in a decision point where the veteran must design a viable launch strategy under severe time and capital constraints. Instead of being restricted to predefined options, students are challenged to generate their own pathway. The following guiding prompts frame analysis and encourage creativity:

-

How should compliance be sequenced to balance legality, timing, and cost?

-

Which financing options (bootstrapping, equity loans, microfinance, CDFIs, or revenue financing) best align with the FEMA 90-day reimbursement cycle?

-

Should the veteran pursue independence, subcontracting/joint ventures, or a franchise/accelerator model? What are the trade-offs in autonomy, cost, and speed?

-

What veteran-focused training or support programs (such as VBOCs, Boots-to-Business, or SBA resources) could accelerate compliance readiness?

-

How would recommendations differ under Kantian duty, utilitarian outcomes, and existential agency?

-

What contingency plans are needed if FEMA reimbursements are delayed or only partially approved?

These prompts are intended to guide analysis, not prescribe answers. They encourage students to balance financial models, compliance strategies, and ethical frameworks in developing their own evidence-based conclusions.

Use of Evidence

This case relies on multiple sources of federal reporting and regulatory authority. To maintain accuracy, these sources are cited descriptively rather than normatively:

-

GAO (2007): Reported data gaps in subcontracting opportunities following Hurricane Katrina. This case interprets those findings from the protagonist’s perspective but does not imply that GAO itself characterizes the impacts as burdensome.

-

SBA regulation (13 CFR Part 128): Establishes the legal requirements for veteran small business certification. The challenge lies in how quickly new entrants can meet these requirements when pursuing post-disaster contracts (Small Business Administration, 2025a).

-

IRS/National Taxpayer Advocate (2023): Documents administrative delays that compound startup burdens.

-

FEMA’s Public Assistance Program and Policy Guide (PAPPG): Outlines the 90-day reimbursement timeline, creating a financial paradox: open opportunities for established firms, but significant barriers for under-capitalized new entrants.

These sources provide the factual foundation for classroom analysis, while interpretation and ethical evaluation remain the responsibility of students.

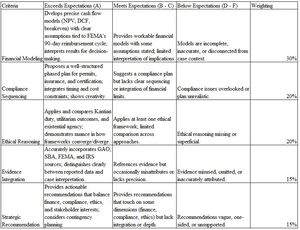

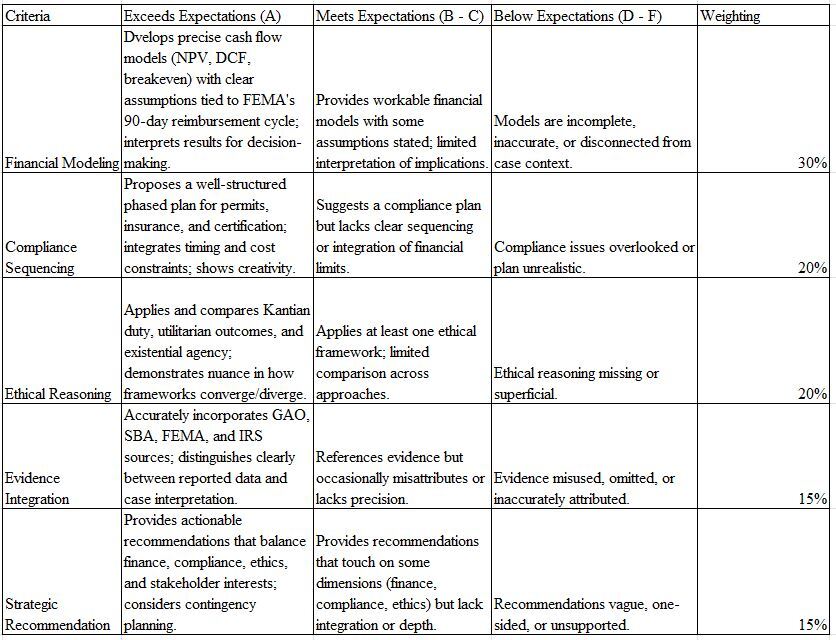

Learning Objectives

By engaging with this case, students should be able to:

-

Differentiate between universal barriers to entrepreneurship and veteran-distinct barriers linked to VA benefits, disability, and certification.

-

Analyze the cash flow pressures created by FEMA’s 90-day reimbursement cycle.

-

Evaluate how taxation and benefit structures shape entrepreneurial decision-making.

-

Apply and compare ethical frameworks, Kantian duty, utilitarian outcomes, and existential agency, to compliance and timing dilemmas.

-

Propose evidence-based strategies that balance financial modeling, regulatory compliance, and ethical responsibility.

Teaching Lens

Students are tasked with building a decision matrix that weighs:

-

Financial viability: cash flow models, NPV, opportunity cost.

-

Accounting integrity: internal controls, audit readiness, cost allocation.

-

Taxation impact: Schedule SE, benefits interaction, income reporting.

-

Ethical weight: Kantian duty, Sartrean agency, stakeholder harm allocation.

Each path forces students to quantify trade-offs while confronting the philosophical reality that in disaster recovery, compliance systems do not just track revenue, they define who gets to participate in rebuilding.

Closing: The Summons to Become

Birth offers no guarantees, only potential. Entrepreneurship is no different. For the veteran, the debris left by Hurricane Milton is more than waste to be cleared, it is a battlefield where accounting systems, insurance policies, and cash flow models decide who gets to rebuild.

The FEMA 90-day reimbursement policy was written to accelerate recovery capital, yet its audit-driven requirements expose a deeper truth: financial structures do not just track transactions, they draw the line between inclusion and exclusion. In this case, a chart of accounts is not just an accounting tool; it is a gatekeeper of agency.

Students are left with two questions that cut through spreadsheets and into policy and principle:

-

When financial and compliance systems reward only those who already have, what is the ethical responsibility of policy designers, lenders, and accountants to expand access?

-

For the protagonist, what does it mean to lead, to risk, and to build when the very framework of economic recovery withholds permission?

This reflection is intended to open inquiry rather than prescribe answers. Students are invited to interpret the protagonist’s dilemma through their own ethical, financial, and strategic reasoning.

Freedom is claimed in action, not granted by systems (Sartre, 1946/2007). Dignity requires treating individuals as ends, not as means (Kant, as cited in Furner, 2017). This case closes without resolution because real-world crises rarely provide tidy endings. Instead, it leaves a mirror reflecting policy intent against human consequence, accounting precision against lived experience, and challenging students to confront the deeper question of what it means to build with nothing but grit.